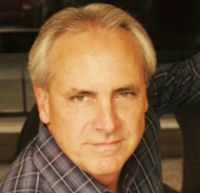

After multiple career reinventions, long-time businessman Barry Johnson finds happiness in professional service franchise, The Interface Financial Group.

In 2010, Barry Johnson found himself doing something he hadn’t done in three decades: putting a resume together.

Johnson, now 58, had spent the last 30 years running four different companies in the Bay Area. He started his career in the mailroom at a packaging company, where he eventually became the CEO. After twenty-five years there, he left to start a new business with his son, where he could teach him the ropes of business.

“This was the first reinvention of myself,” he said as he recalled the change his career path made at the age of 50.

But within a few months they unexpectedly had to sell that business. For the second time in a year, he was looking at yet another reinvention.

“Next, I purchased a construction company. It was very successful, but my silent partner was not so silent. We had different views on how to run the business so when I had an opportunity to sell my part of the business, I did.”

But Johnson wasn’t ready for retirement, nor was he prepared for how difficult it would be to find a new career.

So, then began reinvention number three.

The Move to Franchising: “It’s All About the Legacy” By then, Johnson knew he did not want to build a company from the ground up or buy an existing business. He was all too familiar with the roadblocks on those paths.

“To run a business you start from the ground up – it really comes down to knowledge legacy. You are the knowledge legacy – you have experience and knowledge. It’s kind of like breathing. When you buy another company, you are relying on management in place to lead you down the right path. But in my experience, the management team in place wasn’t as solid as I thought. I wasn’t at a point in my life where I wanted to take that kind of risk or responsibility again.”

He felt that all signs now pointed to franchising.

“In a franchise, they pass the knowledge on to you. It’s the knowledge legacy and how that is transferred to you.” He worked with a broker who introduced him to several concepts, most of them professional services. The Interface Financial Group (IFG) was the one that stuck with him.

There were several reasons why he liked the IFG business concept.

“First, I liked that I would be able to have a successful business with no employees, no inventory, no overhead, and could work out of my home. But what really struck me was their professionalism. They tend to under-promise and over-perform. They didn’t work really hard at trying to reel me in. It was up to me to make it happen.”

Life Now

Johnson underwent a thorough training with IFG before he opened the doors to his franchise in June 2011.

“I’m happy I made the decision. IFG does support you well, and they really do want you to succeed; the quality of the franchisor is very good; their heart is in the right place, and they are honest.”

Johnson is still getting used to having more time on his hands. He now has time and flexibility to do things he enjoys, like play golf while also getting the job done.

“IFG affords a nice lifestyle for someone who has a lot of activities and interests outside of the workday, so I don’t see me working 40 hours a week. My golden retriever also likes that I work about 3 feet from him now.”

The most fulfilling part of the business so far has come from helping other businesses in his community prosper.

“My clients are growing. They are too young to be bankable or they’ve been bloodied and battered during this economy. I’m in a position to help them, and the reality is that they are in a good situation because they are just growing.”

Take for instance the story about a family-run business that recently came to him for alternative financing. The company was started decades ago by a local man but was recently turned over to the owner’s son, who is in his late 20’s. “With a new owner, the bank views them as a new entity even after years and years of making money. I feel good about helping them grow, giving this young man the opportunity to take on that next big new job knowing they will have the cash flow to handle it.”

“Especially after a gloomy economy, it’s great to be a part of this rebound. I’m on the front lines of the small business world, and I see more hope now.”